Evidence of stock ownership that specifies the name of the company the number of shares it represents and the type of stock being issued. Furthermore privately placed bonds dont require credit-agency ratings.

:max_bytes(150000):strip_icc()/dotdash_Final_Everything_You_Need_to_Know_About_Junk_Bonds_Dec_2020-01-5306bf5871c8424bacc317dd8bef5c90.jpg)

Everything You Need To Know About Junk Bonds

Accounting questions and answers.

. Higher foreign growth is likely to increase home country exports and affect current account balance positively. Interest on bonds is. Unsecured bonds Bonds that may be coverted into common stock at the bondholders option G.

Which of the following represents a disadvantage of issuing bonds. Wide universe of corporate issuers and bonds to choose from. There are both advantages and disadvantages to generating capital using this form of debt security.

CBonds increase the firms debt. Up to 256 cash back Given the following information which one of the following choices has only correct statements. The only risks with bonds are inflation and the coupon rate in relation to the official interest rate becoming unfavorable for the lender.

Bonds Represent Debt. The bonds are like IOUs for a large number of small loans which the issuing company pays back on a specified date with or without interest. Bonds are permanent debt on the firms balance sheet B.

All of the following are advantages of issuing bonds except. Issuing bonds is one way for companies to raise money. Which of the following is a disadvantage to current stockholders of issuing additional shares of the stock.

By issuing bonds with a _____ the corporation retains the right to pay off the bonds prior to the maturity date. The corporate bond market is among the most liquid and active in the world. 1 Stockholder control is not affected 2 Earnings per share on common stock may be lower 3 Tax savings result 4 Each of these answer choices is an advantage.

B Dividends are legally required. Nobody loans out funds for free. Pros of Buying Stocks Instead of Bonds.

Which of the following represents a disadvantage of issuing bonds. The disadvantages of issuing bonds and taking on long-term debt are the costs associated with it. 10 million students use Quizplus to study and prepare.

Advantages of issuing bonds. Bonds on the other hand are debt. The money a company receives from issuing debt must be paid back with interest.

A does not dilute control of the corporation b interest expense is tas deductible c generally results in. These payments whether in the form of bond coupon payments or monthly installments can tie up a company. Treasury zeros fall significantly if the.

D Bondholders receive voting rights. Stockholders must be repaid their investment. Then it will pay interest on that loan to investors who have.

There are pros and cons to the use of convertible bonds as a means of financing by corporations. A government corporation or other entity that needs to raise cash will borrow money in the public market. Question Correct Match Selected Match Long term liabilities issued against the general credit of the borrower J.

C Bonds increase the firms debt. Purchasing insurance paying. Disadvantages to issuing bonds Of course when a company borrows money it needs to pay interest to its lenders on a regular basis.

If home inflation rate is lower than foreign inflation exports of home country are likely to increase. 1 bonds increase debt and can adversely affect the markets perception of the firm 2 paying interest on bonds is a legal obligation 3 the face value of bonds. A represents an increase interest expense over the life of the bonds b represents a decrease in interest expense over the life of the bonds.

Issuing bonds publicly means. The chief advantage stocks have over bonds is their ability to generate higher returns. Because of their sensitivity to interest rates zero-coupon Treasury bonds have incredibly high interest rate risk.

Redemption feature B. A company earns a lower return with borrowed funds than it pays in interest. A bond functions as a loan between an investor and a corporation.

Which of the following represents a disadvantage of issuing bonds. Learn about our editorial policies. Borrowing money can also be riskier than the alternatives.

ABonds are permanent debt on the firms balance sheet. Question 1 4 points Which of the following is not an advantage of issuing bonds instead of common stock. As a bank loan officer you are considering a loan application by Peak Performance Sporting Goods.

Issuing stock generally reduces the market value of the firm on the balance sheet. Another advantage of private placement is the cost and time-related savings involved. Dividends are legally required.

Explore answers and other related questions. Issuing bonds to obtain long-term funds legally compels a firm to pay regular _____ payments and repay the _____ at the maturity date. Consequently investors who are willing to take on greater risks in.

Convertible bonds Off-balance sheet financing F. Companies that need money for projects or general operations have the option of offering bonds to the public. When an entity issues a bond it is issuing debt with the promise to pay interest for the use of the money.

Disadvantages of Debt. One of several advantages of this method of equity financing is. The only risks with bonds are inflation and the coupon rate in relation to the official interest rate becoming unfavorable for the lender Answers.

The investor agrees to give the corporation a certain amount of money for a. Identify the following as either an advantage A or a disadvantage D of bond financing. DBondholders receive voting rights.

A company earns a higher return with borrowed funds than it pays in interest. Operating leases The rate. The premium on bonds payable.

Profits are shared among more stockholders D. Bonds do not affect owner control. Which of the following represents a disadvantage of issuing bonds.

A Bonds are permanent debt on the firms balance sheet. It can shift control of the firm C. Question 4 1 out of 1 points Which of the following statements about bonds is not true.

Tend to be less risky and less volatile than stocks. BDividends are legally required.

Par Value Accounting Basics Finance Infographic Accounting Principles

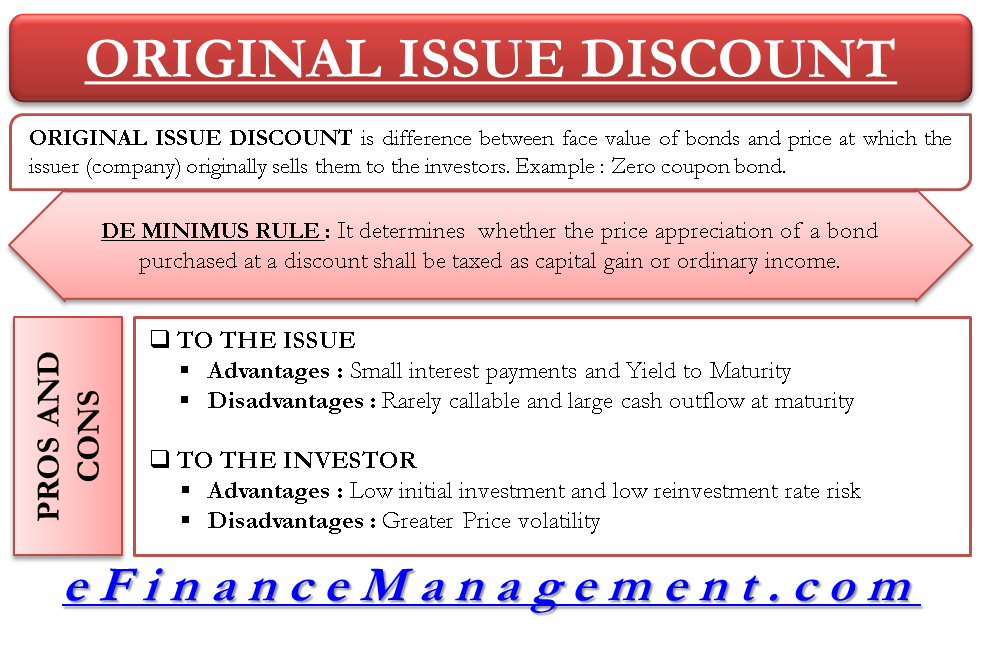

Original Issue Discount Bonds Meaning Accounting Benefits And Drawba

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

0 Comments